Carbon dioxide Emission Credits: Indonesia commences trading – Reuters

INDONESIA, Sept. 26 – Indonesia commenced its maiden trade in carbon credits on Tuesday, with the target of creating a market to fund cuts in greenhouse gas emissions and become a major participant in the world carbon trade.

Indonesia, an archipelago home to the world’s third-largest rainforest area, is also one of the world’s top greenhouse gas emitters. The Southeast Asian country has set a target of reaching carbon neutrality by 2060, Reuters stated.

Some important things you must know about carbon dioxide emission credit trading.

WHAT IS INDONESIA’S CARBON EMISSION TRADING SYSTEM AND HOW DOES IT WORK?

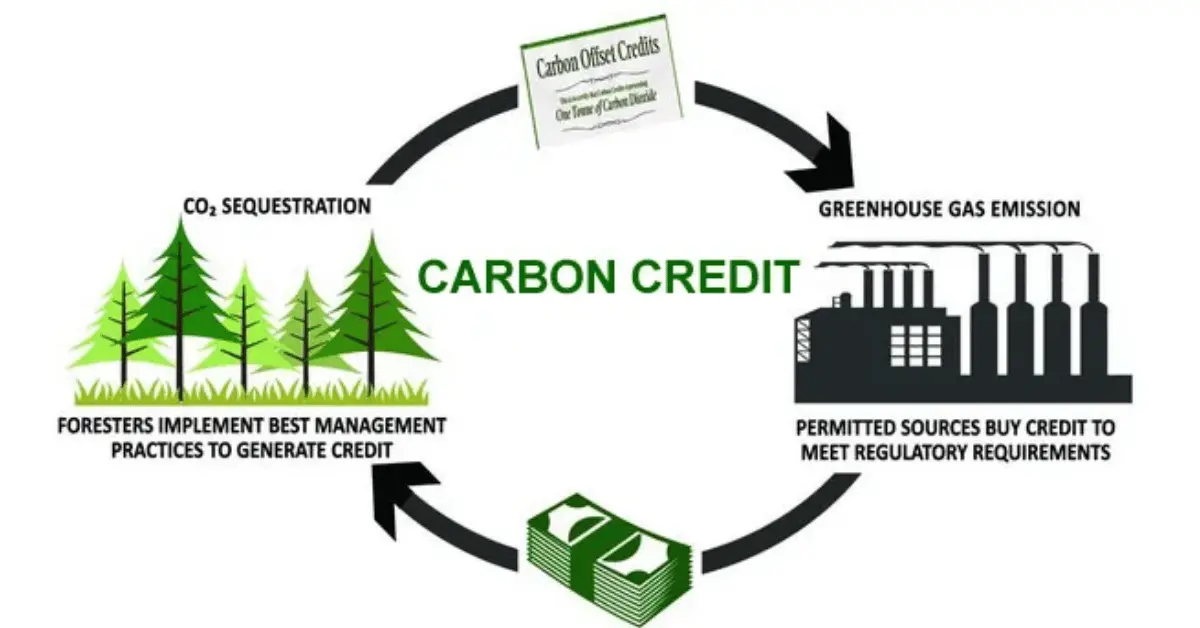

According to Reuters, “Indonesia’s carbon market is designed to facilitate trade of carbon credit certificates issued for a project or an activity that removes greenhouse gas emission from the atmosphere, or for a company that produces carbon emission below a government-set pollution cap.

“The country in February launched the first phase of mandatory carbon trading for coal power plants, involving 99 facilities, where they traded emission allowances.

“Jakarta is currently working on a roadmap that will include emission caps for four other sectors: forestry, industrial processes and production use, agriculture and waste management, as well as a carbon tax for above-cap emissions that have not been offset, officials said, though no time frame was announced.

“The government hopes that the regulations will encourage companies to slash their emissions, while those that raise funds from the market could reinvest in efforts to further reduce emissions.”

WHAT IS THE PRICE?

Thirteen carbon credits for nearly 460,000 metric tonnes of carbon dioxide equivalent (CO2e) from PT Pertamina Geothermal Energy’s projects in Sulawesi were traded, priced at 69,600 rupiah ($4.51) per tonne at the opening of the trade on Tuesday.

Pricing will vary for each project depending on its owner, who is allowed to set the offering prices, said Iman Rachman, president-director at the Indonesia Stock Exchange (IDX), which facilitates the trade.

The energy ministry has said in the February trial for coal power plants, carbon allowances traded within a price range of $2 to $18 per tonne.

For comparison, carbon prices in the European Union have reached above $80 a tonne, while Singapore-based carbon exchange CIX’s June price assessment has benchmarked nature-based avoidance credits issued between 2019 and 2022 at $5.36 per tonne, Reuters noted.

WHO WILL PARTICIPATE?

Trading is currently voluntary, but may become mandatory once stricter pollution rules are applied.

Currently, an emissions cap has only been set for the power sector, so regulators expect utilities will be the most active buyers in the market in the early stage. But once pollution caps are set for sectors, other companies may join.

Banks, units of state energy firm Pertamina and mining companies were among the buyers during Tuesday’s trade.

Companies that have pledged to reach net-zero emissions and those with environmental, social, and governance concerns may also participate, said IDX’s Iman said.

However, the IDX did not provide an estimate for supplies, adding that this will depend on carbon credit certificates issued by the environment ministry.

CAN FOREIGN ENTITIES BUY CARBON CREDITS FROM INDONESIA?

Senior minister Luhut Pandjaitan during the launch said Indonesia wants to get mutual recognition for its exchange so that it can attract foreign buyers to its market at a later stage.

However, any cross-border transactions should not disrupt Jakarta’s own target under the Paris Agreement, he said.

($1 = 15,445.0000 rupiah)